Who We Are

Our success depends on the strength of our team.

Jesse Morales

Mortgage Loan Originator

NMLS: 671221

c/ 818-653-6525 f/ 888-908-9636

e-mail: Jesse@myrealinc.com

Ernesto Guray

Mortgage Loan Originator

NMLS: 819276

c/ 818-554-3595 f/ 888-688-3576

e-mail: Ernesto@myrealinc.com

A CSUN and UCLA alumni, Jesse Morales has been serving people for nearly 20 years as a professional in different fields. After his start as a social worker and acquiring the experience and knowledge that comes with helping others, Jesse Morales shifted towards finance as a securities broker and a financial advisor in 2003 before becoming in a mortgage broker in 2008. The satisfaction with being an integral part in the fulfillment of people’s dreams and goals is the drive Jesse Morales brings to each and every client and this company’s foundation lies at the heart of it.

Ernesto brings to the table years of experience in helping others as well along with a strong background in Finance. After completing his business degree at the University of Maryland and CSUN (Associates in Business Management and a Bachelors in International Business and Marketing), Ernesto Guray set his focus on Insurance, Banking and Finance along with the acquisitions of his Investment Licenses. Working at Chase and Union Bank provided Mr. Guray with a tremendous insight into not only how money and credit work but also into how to help take his clients from point A to point B where there financial goals were concerned. Today, with the motivation from his loving wife May and 2 year old daughter Leilani, Ernesto Guray employs these experiences and tools to provide the best possible long term and short term solutions he can for his clients and associates.

We are the dynamic duo in real estate and lending SOLUTIONS.

Our combined experience and expertise are at your disposal.

Real Estate And Lending Solutions

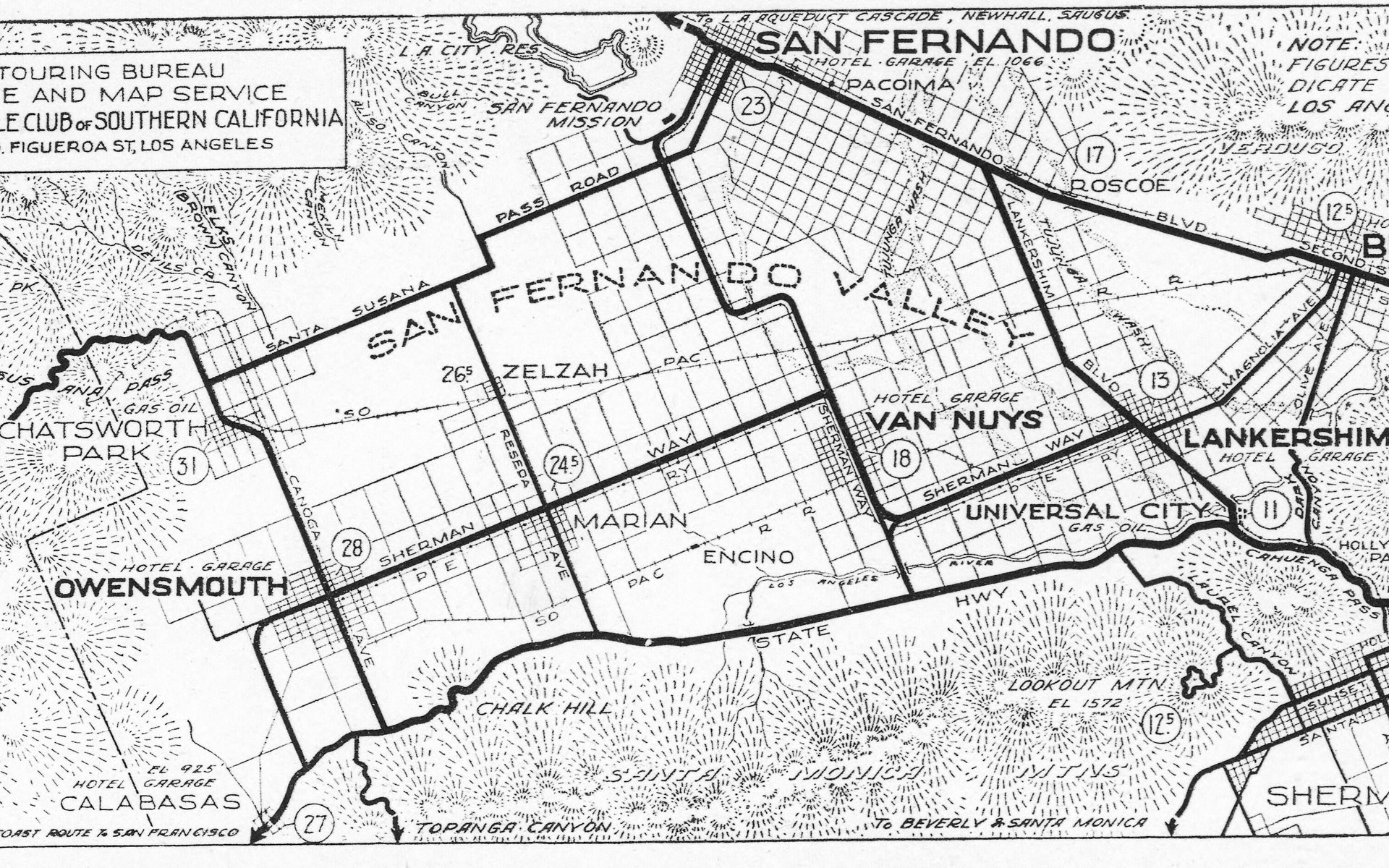

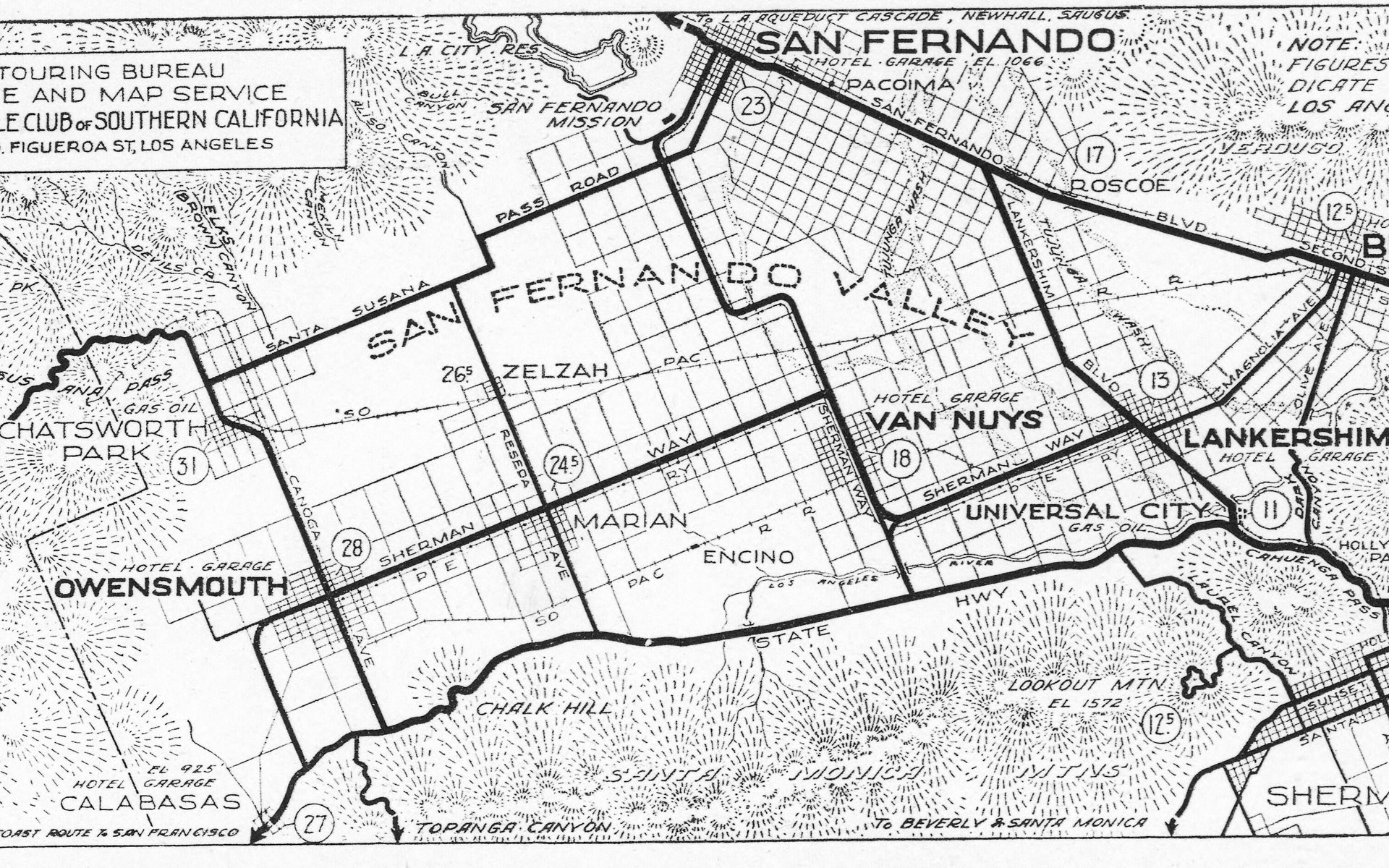

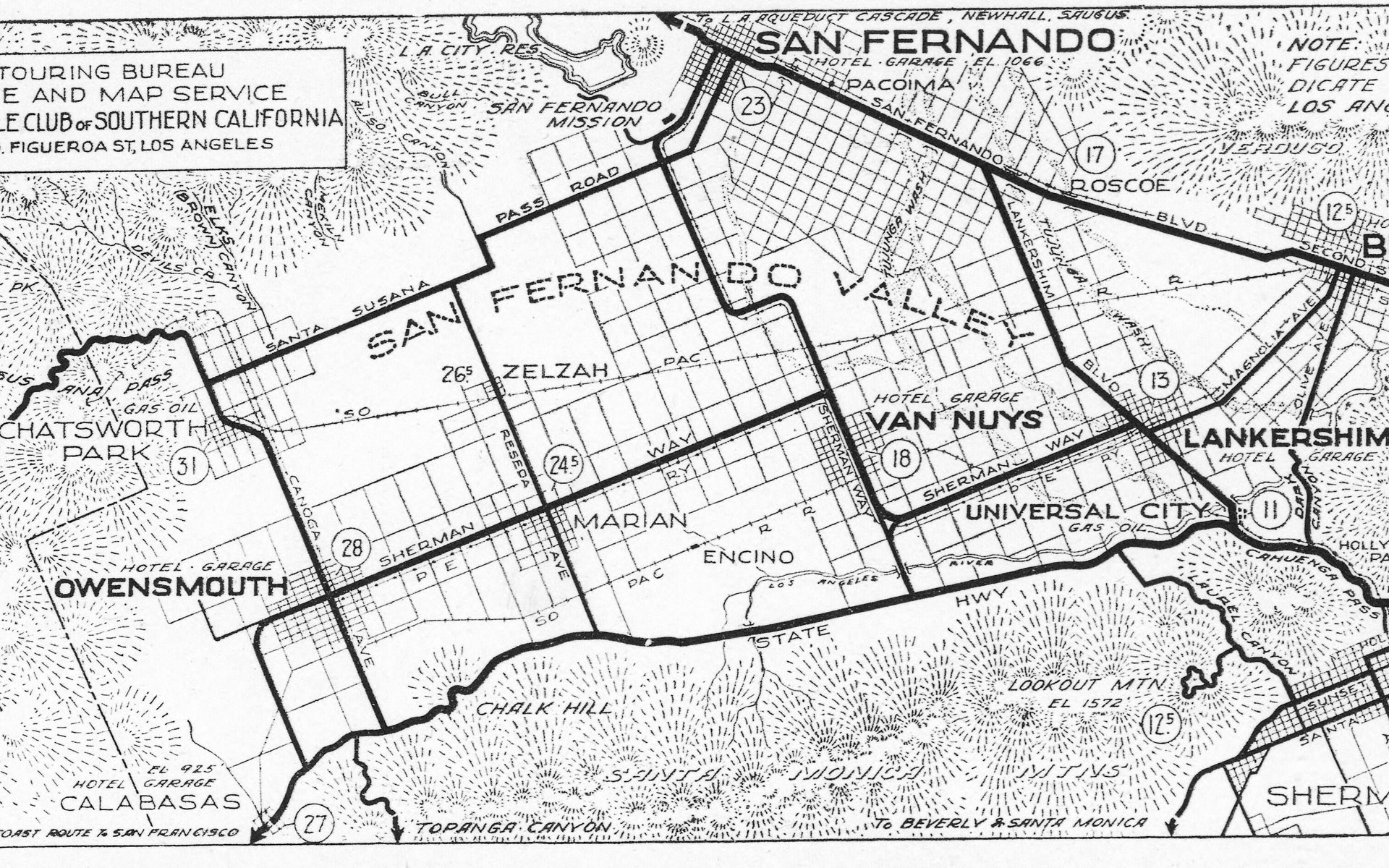

Whether you are in the San Fernando Valley the general Los Angeles area, Palmdale or the surrounding cities - Real Estate and Lending Solutions is there for you. We have decades of experience in serving families all over with financial solutions ranging from mortgages, refinancing and loans while providing a personal service that is both professional and familiar. Need an FHA? Need to lower your rates? Wondering if your credit is good enough? Whatever the query, we are here for you.

Our academic background serves as the foundation upon which our experience was founded on. We have the knowledge and training to reinforce our years of experience to best serve your financial needs.

Our experience in lending and real estate in and around the San Fernando Valley permits us to know the paths and bends that solutions for financial needs may sometimes require. But above all, experience has taught us that next to fulfilling your needs we also aim to establish a long-term relationship.

Education. Experience. Technology. All three facets of our approach to finding solutions for your financial situation are critical to our work ethic and drive to fulfill related tasks.

Here are a few examples of some of the financial solutions we offer:

FHA Loans

Low down payments

Low closing costs

Easy credit qualifying

VA Loans

Down payment not always required

Buyer informed of reasonable value

Negotiable interest rate

Refinance

Cash out

Modify your Payments

Modify your Rate

CalHFA DPA

CalHFA

Down Payment Assistance

program

We Are Here For You

Take your time and research some keywords and frequently asked questions. Remember, we're only a phone call away - call us at (818) 653-6525 or (818) 554-3595.

Loan payments by equal periodic amounts calculated to pay off the debt at the end of a fixed period, including accrued interest on the outstanding balance.

A percentage rate that reflects the amount of interest earned or charged.

An installment payment on a promissory note - usually the final one for discharging the debt - which is significantly larger than the other installment payments provided under the terms of the promissory note.

The difference between the purchase price of real estate and the loan amount. The borrower is responsible for providing the funds for the downpayment.

The difference between the fair market value of a property and the current indebtedness secured on the property.

A situation in which a third party, acting as the agent for the buyer and the seller, carries out the instructions of both and assumes the responsibilities of handling all the paperwork and disbursement of funds at settlement or at closing.

Consideration in the form of money paid for the use of money, usually expressed as an annual percentage. Also, a right, share or title in property.

The ratio of the principal balance of a mortgage loan to the value of the securing property, as determined by the purchase price or Appraised Value, whichever is less.

Both products use your home as collateral.

The main differences between the products are:

Fixed-rate loans have interest rates that don't change during the life of the loan. Adjustable-rate loans have rates that are linked to an index, Prime, and therefore can change over time.

Consider factors that could affect your decision, such as how a higher monthly payment would impact your budget if the rate were to increase and the length of time you plan to stay in your home.

There a numerous reasons customers refinance the loans they already have. Some of these are:

Yes, you can. Your information is reviewed, and a decision is made as to whether you qualify. Contact us to see what information you need to provide. Once pre-approved, you can look for a new home with confidence, and sellers will feel more comfortable dealing with you.

Downloadour forms to print!

You may download our forms to print and save yourself valuable time! You can also e-mail them to us at jesse@myrealinc.com for Jesse Morales or ernesto@myrealinc.com for Ernesto Guray.

Prequalification Checklist

Before you submit your prequalification or come to our office to meet us - review this handy document to ensure you have everything you need!

Purchase Documentation Checklist

Have all your documents in hand? Checkout this Purchase Documentation Checklist to make sure you do.

Refinance Checklist

Before you submit your REFI paperwork, have a glance at this document to make sure there are no delays due to missing paperwork or conent.

If you have any further questions, you can always reach us by phone or in person. We love technology, but we also love interacting personally. That being said, we know your time is precious and these documents may help you save some of it.

Keep In Touch

Jesse Morales: +1 (818) 653-6525

E-mail: jesse@myrealinc.com

Fax: +1 (888) 908-9636

Ernesto Guray: +1 (818) 554-3595

E-mail: ernesto@myrealinc.com

Fax: +1 (888) 688-3567

208 N Maclay Ave

San Fernando, Ca 91340